| Question: | 101. What refers to a document that shows proof of legal ownership of a financial security? |

| A. Bond |

| B. Bank note |

| C. Coupon |

| D. Check |

| Answer: | C |

| Question: | 102. What type of bond is issued jointly by two or more corporations? |

| A. Mortgage bond |

| B. Joint bond |

| C. Tie-up bond |

| D. Trust bond |

| Answer: | B |

| Question: | 103. What type of bond whose guaranty is in lien on railroad equipment, such as freight and passenger cars, locomotives, etc.? |

| A. Railroad bond |

| B. Equipment obligation bond |

| C. Equipment bond |

| D. Equipment trust bond |

| Answer: | B |

| Question: | 104. A type of bond to which are attached coupons indicating the interest due and the date when such interest is to be paid is called ______. |

| A. Registered bond |

| B. Coupon bond |

| C. Mortgage bond |

| D. Collateral trust bond |

| Answer: | B |

| Question: | 105. What bond whose security is a mortgage on certain specified assets of the corporation? |

| A. Registered bond |

| B. Collateral trust bond |

| C. Mortgage bond |

| D. Debenture bond |

| Answer: | C |

| Question: | 106. A bond without any security behind them except a promise to pay by the issuing corporation is called ______. |

| A. Joint bond |

| B. Debenture bond |

| C. Trust bond |

| D. Common bond |

| Answer: | B |

| Question: | 107. A type of bond where the corporation pledges securities which it owns such as the stock or bonds of one of its subsidiaries. |

| A. Mortgage bond |

| B. Joint bond |

| C. Security bond |

| D. Collateral trust bond |

| Answer: | D |

| Question: | 108. What type of bond where the corporation’s owner name are recorded and the interest is paid periodically to the owners with their asking for it? |

| A. Preferred bond |

| B. Registered bond |

| C. Incorporators bond |

| D. Callable bond |

| Answer: | B |

| Question: | 109. What type of bond which can be redeemed before maturity date? |

| A. Preferred bond |

| B. Registered bond |

| C. Incorporators bond |

| D. Callable bond |

| Answer: | D |

| Question: | 110. What is the feature of some bonds whereby the issuer can redeem it before it matures? |

| A. Return clause |

| B. Callability |

| C. Recall clause |

| D. Call class |

| Answer: | B |

| Question: | 111. The price at which the callable bond will be redeemed from the bondholder is called ______. |

| A. Par value |

| B. Call value |

| C. Face value |

| D. Redemption value |

| Answer: | B |

| Question: | 112. What is defined as the reduction or fall of the value of an asset due to constant use and passage of time? |

| A. Depletion |

| B. Inflation |

| C. Depreciation |

| D. Deflation |

| Answer: | C |

| Question: | 113. In what method of computing depreciation where it assumes that the loss in value is directly proportional to the age of the equipment or asset? |

| A. Straight line method |

| B. Sinking fund method |

| C. Sum-of-year digit method |

| D. Declining balance method |

| Answer: | A |

| Question: | 114. In what method of computing depreciation where it assumes that a sinking fund is established in which funds will accumulate for replacement purposes? |

| A. Straight line method |

| B. Sinking fund method |

| C. Sum-of-year digit method |

| D. Declining balance method |

| Answer: | B |

| Question: | 115. In what method of computing depreciation where it assumes that the annual cost of depreciation is a fixed percentage of the book value at the beginning of the year? |

| A. Straight line method |

| B. Sinking fund method |

| C. Sum-of-year digit method |

| D. Declining balance method |

| Answer: | D |

| Question: | 116. In SYD method of computing depreciation, which of the following is the formula in finding the sum of years’ digits? |

| A. image |

| B. image |

| C. image |

| D. image |

| Answer: | C |

| Question: | 117. The declining balance method is also known as ______. |

| A. Double percentage method |

| B. Constant percentage method |

| C. Modified sinking fund method |

| D. Modified SYD method |

| Answer: | B |

| Question: | 118. What type of depreciation is due to the reduction in the demand for the function that the equipment or asset was designed to render? |

| A. Functional depreciation |

| B. Design depreciation |

| C. Physical depreciation |

| D. Demand depreciation |

| Answer: | A |

| Question: | 119. What type of depreciation is due to the reduction of the physical ability of an equipment or asset to produce results? |

| A. Functional depreciation |

| B. Design depreciation |

| C. Physical depreciation |

| D. Demand depreciation |

| Answer: | C |

| Question: | 120. The functional depreciation is sometimes called ______. |

| A. Demand depreciation |

| B. Adolescence |

| C. Life depreciation |

| D. Failure depreciation |

| Answer: | B |

| Question: | 121. What is defined as the reduction of the value of certain natural resources such as mines, oil, timber, quarries, etc. due to the gradual extraction of its contents? |

| A. Depletion |

| B. Inflation |

| C. Depreciation |

| D. Deflation |

| Answer: | A |

| Question: | 122. What are the common methods of computing depletion charge? |

| A. Rational method and irrational method |

| B. Conservative method and conventional method |

| C. Unit method and percentage method |

| D. Discrete method and depletion allowance method |

| Answer: | C |

| Question: | 123. Under the depletion allowance method in computing depreciation, the depletion charge is equal to either ______ whichever is smaller. |

| A. Fixed percentage of gross income or the net taxable income |

| B. Fixed percentage of gross income or 50% of the net taxable income |

| C. 50% of the fixed percentage of gross income or 50% of the net taxable income |

| D. 50% of the fixed percentage of gross income or the net taxable income |

| Answer: | B |

| Question: | 124. The depletion allowance method of computing depletion is commonly known as ______. |

| A. Unit method |

| B. Percentage method |

| C. Factor method |

| D. Sinking fund method |

| Answer: | B |

| Question: | 125. What is another term for “unit method” for computing depletion? |

| A. Initial cost method |

| B. Percentage method |

| C. Factor method |

| D. Sinking fund method |

| Answer: | C |

| Question: | 126. Using factor method, the depletion at any given year is equal to: |

| A. Initial cost of property times number of unit sold during the year divided by the total units in property |

| B. Initial cost of property divided by the number of units sold during the year |

| C. Initial cost of property times number of units sold during the year |

| D. Initial cost of property divided by the total units in property |

| Answer: | A |

| Question: | 127. What do you call the after-tax present worth of all depreciation effects over the depreciation period of the asset? |

| A. Asset recovery |

| B. Depreciation recovery |

| C. Period recovery |

| D. After-tax recovery |

| Answer: | B |

| Question: | 128. A mathematical expression also known as the present value of annuity of one is called ______. |

| A. Load factor |

| B. Demand factor |

| C. Sinking fund factor |

| D. Present worth factor |

| Answer: | D |

| Question: | 129. The amount of property in which a willing buyer to a willing seller for the property when neither one is under the compulsion to buy nor to sell is called ______. |

| A. Fair value |

| B. Market value |

| C. Good will value |

| D. Book value |

| Answer: | B |

| Question: | 130. Salvage value is sometimes known as ______. |

| A. Scrap value |

| B. Going value |

| C. Junk value |

| D. Second-hand value |

| Answer: | D |

| Question: | 131. What refers to the value of an asset which a disinterested third party, different from the buyer and seller, will determine in order to establish a price acceptable to both parties? |

| A. Book value |

| B. Market value |

| C. Fair value |

| D. Franchise value |

| Answer: | C |

| Question: | 132. What refers to the value of an intangible item which arises from the exclusive right of a company to provide a specified product and service in a certain region of the country? |

| A. Company value |

| B. Going value |

| C. Goodwill value |

| D. Franchise value |

| Answer: | D |

| Question: | 133. The first cost to be incurred if the piece of equipment now in place had been bought for a second hand dealer or some other business is called ______. |

| A. Material cost |

| B. Fixed cost |

| C. First cost |

| D. In-place value |

| Answer: | D |

| Question: | 134. In computing depreciation of an equipment, which of the following represents the first cost? |

| A. The original purchase price and freight charges |

| B. Installation expenses |

| C. Initial taxes and permit fees |

| D. All of the above |

| Answer: | D |

| Question: | 135. The process of determining the value or worth of a physical property for specific reason is called ______. |

| A. Investment |

| B. Valuation |

| C. Economy |

| D. Depletion |

| Answer: | B |

| Question: | 136. The unrecovered depreciation which results due to poor estimates as to the life of the equipment is called ______. |

| A. Sunk cost |

| B. Economic life |

| C. In-place value |

| D. Annuity |

| Answer: | A |

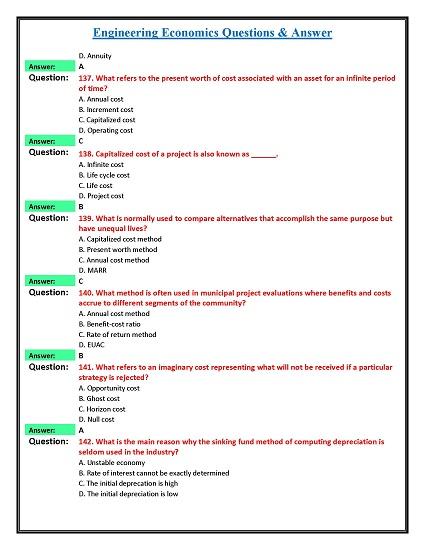

| Question: | 137. What refers to the present worth of cost associated with an asset for an infinite period of time? |

| A. Annual cost |

| B. Increment cost |

| C. Capitalized cost |

| D. Operating cost |

| Answer: | C |

| Question: | 138. Capitalized cost of a project is also known as ______. |

| A. Infinite cost |

| B. Life cycle cost |

| C. Life cost |

| D. Project cost |

| Answer: | B |

| Question: | 139. What is normally used to compare alternatives that accomplish the same purpose but have unequal lives? |

| A. Capitalized cost method |

| B. Present worth method |

| C. Annual cost method |

| D. MARR |

| Answer: | C |

| Question: | 140. What method is often used in municipal project evaluations where benefits and costs accrue to different segments of the community? |

| A. Annual cost method |

| B. Benefit-cost ratio |

| C. Rate of return method |

| D. EUAC |

| Answer: | B |

| Question: | 141. What refers to an imaginary cost representing what will not be received if a particular strategy is rejected? |

| A. Opportunity cost |

| B. Ghost cost |

| C. Horizon cost |

| D. Null cost |

| Answer: | A |

| Question: | 142. What is the main reason why the sinking fund method of computing depreciation is seldom used in the industry? |

| A. Unstable economy |

| B. Rate of interest cannot be exactly determined |

| C. The initial deprecation is high |

| D. The initial depreciation is low |

| Answer: | D |

| Question: | 143. What is the factor name of the formula (1+i)^-n? |

| A. Uniform gradient future worth |

| B. Capital recovery |

| C. Single payment present worth |

| D. Single payment compound amount |

| Answer: | C |

| Question: | 144. What is the factor name of the formula [i(1+i)^n]/[((1+i)^n)-1]? |

| A. Uniform series sinking fund |

| B. Capital recovery |

| C. Single payment present worth |

| D. Uniform gradient future worth |

| Answer: | B |

| Question: | 145. A form of business organization in which a person conducts his business alone and entirely for his own profit, being solely responsible for all its activities and liabilities. |

| A. Sole proprietorship |

| B. Entrepreneurship |

| C. Partnership |

| D. Corporation |

| Answer: | A |

| Question: | 146. Is an artificial being created by operation of law, having the right of succession and the process, attributes and properties expressly authorized by the law or incident to its existence. |

| A. Corporation |

| B. Property |

| C. Partnership |

| D. Organization |

| Answer: | A |

| Question: | 147. What is the simplest form of business organization? |

| A. Sole proprietorship |

| B. Partnership |

| C. Enterprise |

| D. Corporation |

| Answer: | A |

| Question: | 148. Double taxation is a disadvantage of which business organization? |

| A. Sole proprietorship |

| B. Partnership |

| C. Corporation |

| D. Enterprise |

| Answer: | C |

| Question: | 149. In case of bankruptcy of a partnership, |

| A. The partners are not liable for the liabilities of the partnership |

| B. The partnership assets (excluding the partners personal assets) only will be used to pay the liabilities |

| C. The partners personal assets are attached to the debt of the partnership |

| D. The partners nay sell stock to generate additional capital |

| Answer: | B |

| Question: | 150. Which is true about partnership? |

| A. It has a perpetual life. |

| B. It will be dissolved if one of the partners ceases to be connected with the partnership. |

| C. It can be handed down from one generation of partners to another. |

| D. Its capitalization must be equal for each partner. |

| Answer: | C |